CDFIs, or Community Development Financial Institutions, are important tools for reducing the climate impact of buildings. Community-based organizations tackling climate change and environmental justice can benefit significantly from partnering with CDFIs as part of their funding strategy.

What are CDFIs?

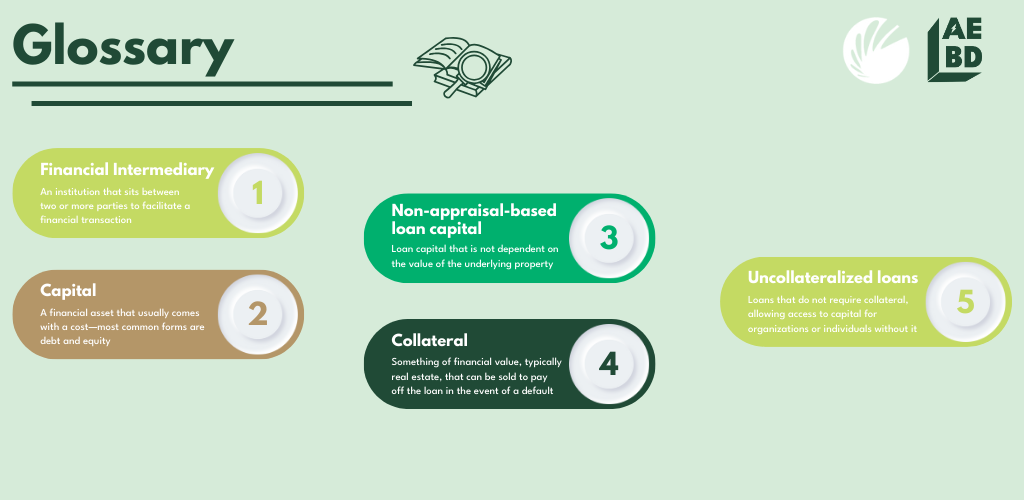

Community Development Financial Institutions or “CDFIs” are private-sector, financial intermediaries with community development as their primary mission. While the nation’s CDFIs share a common mission, they have a variety of structures and serve a variety of organizations and people. The four primary types of CDFIs are:

- Community development banks

- Credit unions

- Loan funds

- Venture capital funds

My name is Stephen Westbrooks, and I currently serve as an Executive Director for a large CDFI called IFF. IFF supports non-profits with access to funding and technical assistance for real estate projects. Over its 36-year history, IFF has lent over $1.5 billion to non-profits and has helped develop high-quality non-profit facilities that have strengthened organizations’ ability to deliver high-impact programs and services.

Given their role as a financial intermediary, CDFIs have supported solutions to a number of challenges faced by historically divested communities, such as redlining, COVID, and now the growing climate crisis.

CDFIs as a Response to Redlining

CDFIs are important intermediaries that help traditional banks maintain compliance with the Community Reinvestment Act of 1977 (CRA). The Community Reinvestment Act was created to address the systematic exclusion of people of color from the traditional banking system. The legislation requires bank regulators such as the Federal Reserve to monitor financial institutions to ensure they are meeting the credit needs of their communities, including communities with low and moderate incomes.

How Do CDFIs Work?

Banks invest in CDFIs to get both a financial return as well as compliance credit with their regulators for meeting the goals of CRA. CDFIs relend that investment into historically divested communities. For example, IFF receives investment from very large banks like JP Morgan Chase, as well as small community banks like Carrollton Bank. This funding is then pooled and relent to non-profits across the Midwest to support the development of high-quality community-based projects.

Why it Matters:

Access to loans is necessary to participate in our economic system. For example, it is difficult to fund important work without mortgages that allow the purchase of buildings and property. Due to historical and racially discriminatory practices such as redlining, people of color have been segregated from participating in the banking system. This not only prevents them from building wealth, but also forces them into predatory lending in emergency situations.

CDFIs as a Response to COVID19

One example of the important role of CDFIs can be seen in the early stages of the COVID19 pandemic, where they were instrumental in the Paycheck Protection Program or “PPP”. Enacted as part of the Coronavirus Aid, Relief, and Economic Security Act or “CARES Act”, PPP provided small businesses and nonprofit organizations with approximately $800 billion in low-interest, uncollateralized loans.

However, the PPP program lacked equity in loan approval—only 12% of businesses or organizations owned by people of color received PPP funding. IFF and other CDFIs recognized that funding was not being given equitably and stepped in to support. IFF partnered with non-profits led by people of color to access funding that they were being excluded from through the traditional banking system. In 2020, IFF partnered with another CDFI, Community Capital Loan Fund to package and close 159 loans to Midwestern non-profits totaling more than $21 million.

Why it Matters:

With the uncertainty of the COVID19 pandemic and governmental restrictions on travel, many businesses were facing critical financial challenges. In order for businesses to stay open and keep from going out of business, cash to continue paying employees and bills was extremely time sensitive. However, small businesses and nonprofits who sought access to PPP loans were often at the back of the line at traditional banks, behind larger clients.

CDFIs as a Response to the Climate Crisis

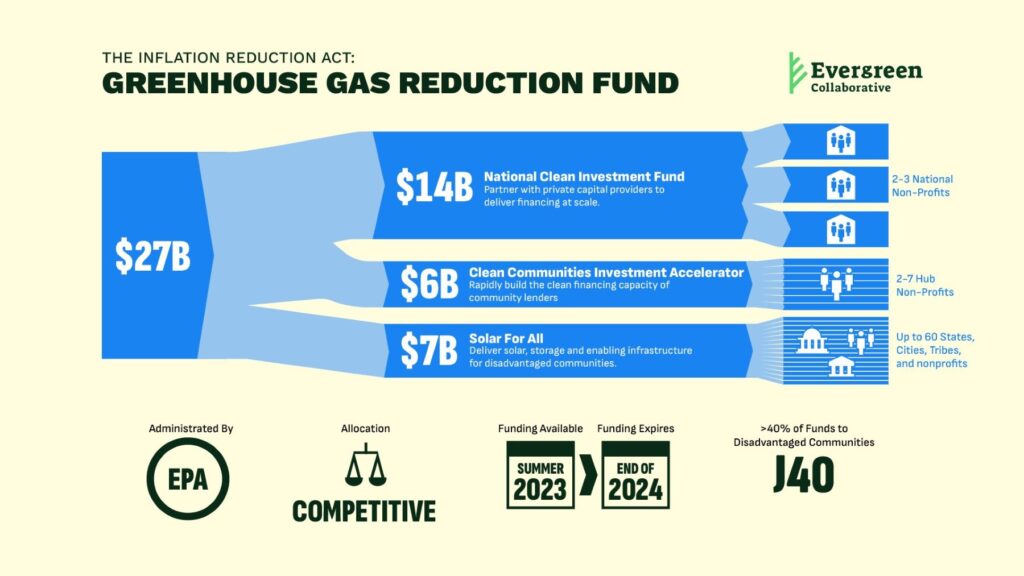

The Greenhouse Gas Reduction Fund (GGRF) is a $27 billion federal government investment to mobilize capital to address the worsening climate crisis, especially in historically divested communities. CDFIs are well-positioned intermediaries that will facilitate access to this unprecedented investment into low-income and low-wealth communities.

The GGRF’s components include the Clean Communities Investment Accelerator, the National Clean Investment Fund, and Solar for All. CDFIs can facilitate efficient capital flows for each component.

How Can CDFIs Support Divested Communities?

CDFIs can pair public and private investment (typically from traditional banks for CRA credit), effectively leveraging the public investment and creating more capital for important community projects. In simple terms, a $6 billion public investment in CDFIs can become over $30 billion or more in investment in decarbonization projects in divested communities.

Why it Matters:

It is critical for this funding to flow from the federal government directly into the communities that need it the most. However, divested communities aren’t a priority for traditional banks, and that may create a barrier to the flow of funding. CDFIs are an intermediary to bridge the gap between the funding source and the organizations and communities doing climate change mitigation projects.

How is IFF Supporting Building Decarbonization?

IFF is currently working directly with the federal government and other CDFIs across the nation to develop the infrastructure through which the GGRF dollars will flow. As a CDFI with values rooted in equity, IFF is well-positioned through deep relationships in low-to-moderate income communities to facilitate important investment into high-impact, decarbonization projects where funding is needed most. We have already begun helping non-profit leaders consider how their organizations can increase energy efficiency, reduce carbon emissions, and otherwise embrace environmental sustainability.

CDFIs have a long history of delivering federal dollars to underserved markets more effectively and efficiently than traditional lenders. The GGRF is a once-in-a-generation opportunity to support the development of sustainable, high-quality community facilities and affordable housing that also directly reduces our impact on our global climate. If history is a guide, CDFIs will be instrumental in facilitating tens of billions of dollars in direct investment into our nations’ historically disinvested communities

Where Can I Learn More?

Books on systemic racism in the banking system:

About the AEBD project

ISC’s Advancing Equitable Building Decarbonization (AEBD) project focuses on growing community capacity to implement equitable building decarbonization in communities of color. This project convenes leadership alliances in Oakland, CA, St. Louis, MO and Philadelphia, PA to implement demonstration projects and develop replicable products for directing resources toward Black and brown building owners. Learn more about AEBD and project participants.

About the Author

Stephen Westbrooks currently serves as Executive Director of IFF’s Southern Region. As Executive Director, Stephen is responsible for providing strategic leadership and management of operations, lending and consulting activities in Southern Illinois, Missouri and Kansas. Previous to serving as Executive Director—Southern Region, Stephen led IFF’s lending practice in the Southern Region, where he lent to projects including early childhood centers, fresh food access and general human services sectors. Stephen received a Bachelor of Science in Economics from Vanderbilt University in Nashville, Tennessee and a Masters of Business Administration from Washington University in St. Louis.

About the Author

IFF is a CDFI certified by the U.S. Department of the Treasury and one of only a few nationally to hold the top-ranked Aeris four-star rating for impact management and AAA rating for financial strength and performance. Grounded in equity and deep sector expertise, IFF champions non-profits to shape more equitable and vibrant communities through community-centered lending, development, and real estate consulting.